Bankruptcy Lawyer vs. Insolvency Trustee: Which to Choose?

When debt feels like it is taking over your life, deciding to file for bankruptcy in Canada might be one of the toughest calls you will make. But here is where it can get confusing: who should you turn to for help? Do you need a bankruptcy lawyer or a Licensed Insolvency Trustee (LIT)? Both are pros in the world of debt relief in Canada, but they are not exactly the same.

In this post, we will break down what a bankruptcy lawyer does vs. what a Licensed Insolvency Trustee does—so you can make the right choice for your situation.

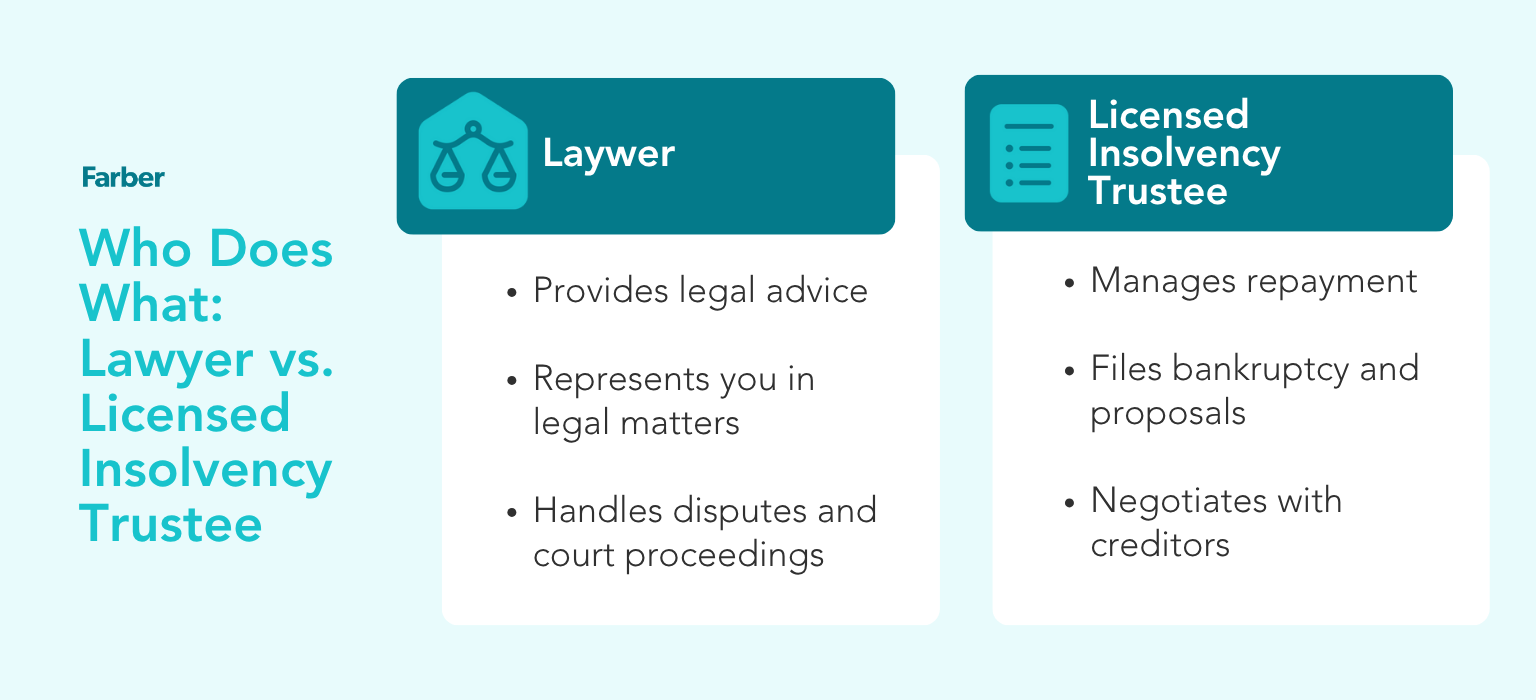

Bankruptcy Lawyers vs. Licensed Insolvency Trustees: What Do They Do?

In Canada, the process of filing for bankruptcy or a consumer proposal is handled only by Licensed Insolvency Trustees (LITs). They are regulated by the Office of the Superintendent of Bankruptcy (OSB), which ensures that only those who meet the requirements and qualifications can act as trustees.

The role of lawyers in Canada is different from that of the LITs. While lawyers can provide advice on legal aspects of debt issues (including rights, obligations, and potential solutions), they cannot directly file for bankruptcy or consumer proposals. They also cannot act as trustees in bankruptcy proceedings.

What Does a Bankruptcy Lawyer Do?

Here is what a bankruptcy lawyer brings to the table:

- Clarifying Legal Terms: Bankruptcy lawyers can help explain complex legal language, ensuring you fully understand your options and responsibilities.

- Court Representation: Got a creditor taking you to court? A bankruptcy lawyer can step in to protect your interests and handle any legal battles.

- Dealing with Complex Situations: Bankruptcy lawyers can help you deal with difficult legal issues that might pop up during your bankruptcy process.

When Should You Call a Bankruptcy Lawyer?

Here are some scenarios where a bankruptcy lawyer might be necessary in Canada:

1. Revival of a Failed Consumer Proposal

If a consumer proposal fails and cannot be revived by the trustee, a bankruptcy lawyer may be involved to help with the legal process to potentially reinstate or address the failed proposal, especially if there is a legal issue or conflict.

2. Discovery of Undisclosed Assets or Fraudulent Transfers

If the trustee uncovers that the debtor has transferred property to others or failed to disclose assets, a bankruptcy lawyer might be needed to deal with legal issues. This could include fraud, non-disclosure, or improper transfers, and help resolve any legal actions it causes.

3. Creditor Opposition to Discharge from Bankruptcy

If creditors oppose the debtor’s discharge from bankruptcy, this creates a legal dispute. Lawyers can assist in defending the debtor’s position and negotiating with creditors, especially if the discharge process becomes complicated.

4. Deceased Debtors and Court Approval for Bankruptcy/Proposal

If a person passes away and there are unresolved debts, or if an estate needs to file for bankruptcy or a consumer proposal, a bankruptcy lawyer might be required. They can help you navigate the filing on behalf of the deceased individual’s estate. In some cases, the court’s approval is required, and a lawyer can assist with the application.

What Does a Licensed Insolvency Trustee Do?

Licensed Insolvency Trustees (LITs) are authorized by the government to manage debt solutions and help people facing financial difficulties find ways to get out of debt. Here is what they can do for you:

- Handling Bankruptcy and Consumer Proposals: If you are looking to file for bankruptcy or a consumer proposal, only a LIT can officially handle that for you. They help you find legal ways to reduce what you owe and get some financial relief.

- Dealing with Creditors: LITs work with your creditors to come up with payment terms that you can manage. They are like the middleman between you and the people you owe, making things a little less stressful.

- Keeping You on Track with Repayment Plans: When it comes to a consumer proposal, a LIT makes sure you are sticking to the plan, so you can focus on moving forward without constantly worrying about every payment.

When Should You Work with a LIT?

If you are ready to tackle your debt and want to work with someone who can officially manage the bankruptcy process or set up a consumer proposal, then a Licensed Insolvency Trustee is the person you need. Reach out to a LIT when:

- You are seriously considering bankruptcy and need someone to guide you through it.

- You want to negotiate with creditors but do not need legal representation.

- You are looking for alternatives to bankruptcy, like a consumer proposal, which can only be set up by a LIT.

Key Differences Between Bankruptcy Lawyers and LITs

So, who do you actually need—a bankruptcy lawyer or a LIT? Here is the scoop:

- Bankruptcy Lawyers: They focus on the legal side of things—court cases, complex legal advice, and representing you if things get sticky with creditors.

- Licensed Insolvency Trustees: They handle the actual bankruptcy process, manage consumer proposals, and work directly with creditors to make things a bit easier on you.

Both professionals are valuable, but knowing the difference can help you pick the one that is best for your specific situation.

How to Decide Who is Right for You

Still not sure who to call? Here is a quick rundown:

- If you need legal backup: A bankruptcy lawyer is your best bet if you are facing lawsuits or have a complicated case that needs legal help.

- If you are ready to dive into debt management: A LIT is the only person who can officially file your bankruptcy or set up a consumer proposal. They are focused on restructuring your debt, negotiating with creditors, and guiding you through the insolvency process—no court required.

- If you need a mix of both: Sometimes, people need both a lawyer and a LIT. For example, you might work with a LIT to manage your debt restructuring and bring in a bankruptcy lawyer if any additional legal issues pop up.

Why It Is Good to Know LITs Are Regulated

One reassuring thing about working with a LIT? They are regulated by the federal government in Canada. This means they follow strict standards, so everything stays fair and transparent. The government makes sure LITs are trained, licensed, and operate ethically, so you can feel confident that they are handling your debt relief the right way.

Because they are federally regulated, LITs have to act in your best interest, handling all financial matters responsibly and safely. This level of oversight protects you as you work to get your finances back on track, giving you peace of mind that you are in good hands.

How Farber Can Help

Farber, we are all about helping you make the best choice for your financial health. If you are feeling overwhelmed with debt, trying to decide which debt-relief solution is best for you, or just curious about your options, our Licensed Insolvency Trustees are here to guide you through every step.

If debt is keeping you up at night, do not hesitate to reach out. We offer a free, no-obligation consultation to discuss your needs and find the best path forward. Our goal is to make this journey as smooth as possible, so you can focus on what truly matters: rebuilding your financial health and peace of mind.

Get out of debt

We offer a powerful debt-relief solution that can significantly reduce your debt without the drawbacks of declaring bankruptcy.

Take the first step

Book a free, confidential, no-obligation consultation and together, we can make a plan to help regain control of your money.

What you need to know

Although debt can be overwhelming, there are ways to start fresh and improve your relationship with money.