Collection Agencies Taking You to Court: What To Know

Are you worried about getting sued by a collection agency because of unpaid debt? You might be asking yourself, can a collection agency take you to court? The short answer is yes, they can take you to court, but it is not always the first step, and it does not happen in every situation.

If you are dealing with debt collectors and feeling stressed, do not panic. There are steps you can take to avoid legal action and get back on track. In this article, we will cover what a collection agency is, how they get involved, what they can legally do, and what happens if they do take you to court.

And of course, if you need help with debt relief, Farber is here for you every step of the way. Dealing with debt and collection agencies is stressful, but you do not have to do this alone. If you would like to speak with a debt expert, you can book a free, no-obligation consultation to explore your debt-relief options.

What Exactly is a Collection Agency?

A collection agency is a company that works on behalf of creditors, the people or businesses you owe money to. They act as the agent for the creditor, to collect unpaid debts from those that owe them debt.

If you have fallen behind on a loan, credit card payment, or even a utility bill, your original creditor might turn the debt over to a collection agency. When you get those pesky collection calls and mail, they are from the collection agency on behalf of the creditor.

How Do Collection Agencies Get Involved?

Here is how it works: after you miss a few payments and your creditor has not been able to get you to pay, they might sell your debt to a collection agency. This is called debt purchasing. The collection agency buys a bunch of unpaid debts, called a debt portfolio, for less than what is owed.

So, if you owe $1,000 to a creditor, a collection agency might buy that off them for, let’s say, $800. Now that they have that debt, they will still try to collect the full $1,000 from you to make that profit. It is a business after all.

So, if you owe $1,000, the agency may have paid only a portion of that to buy your debt, but they’ll still try to collect the full $1,000 from you.

What Can a Collection Agency Legally Do?

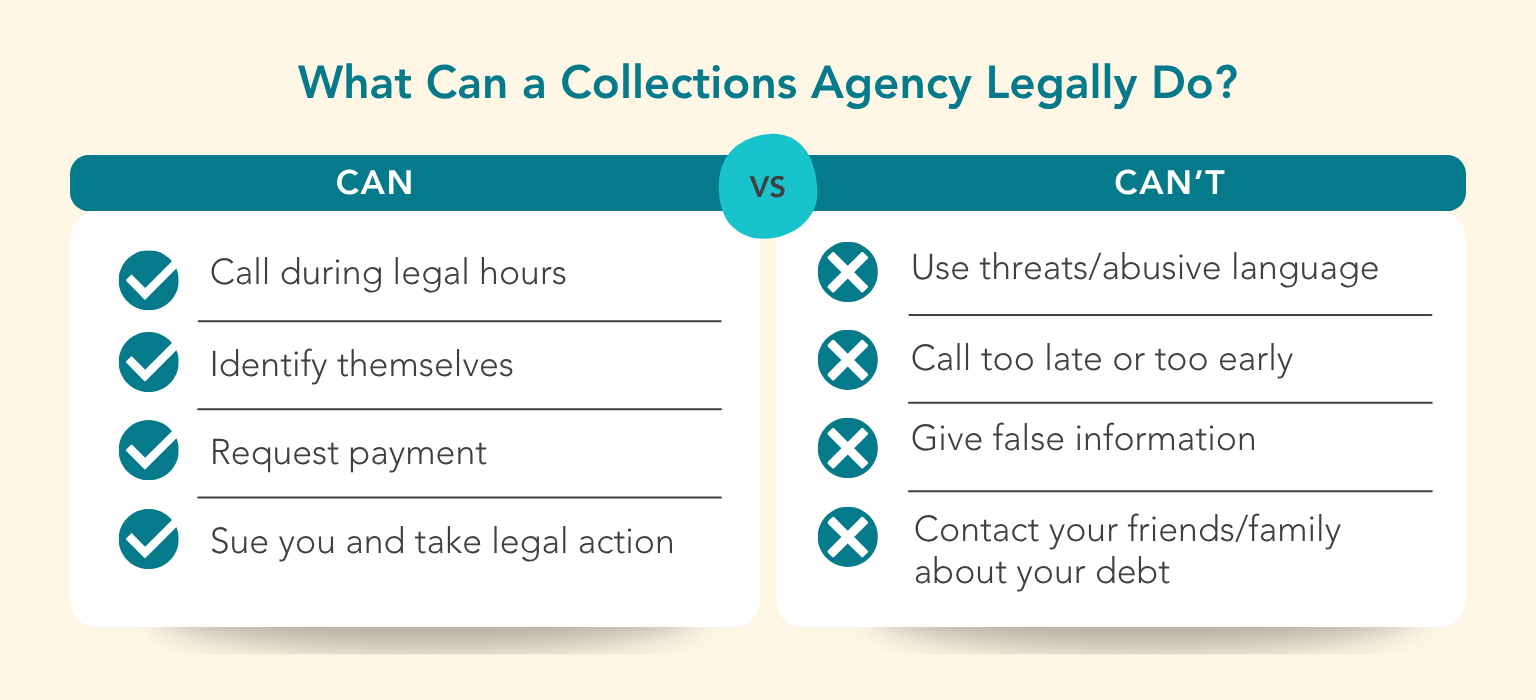

In Canada, collection agencies have to follow strict rules about how they can contact you and what they can do to recover the money. These rules are in place to protect you from unfair practices. For example, they:

- Cannot call you at odd hours, like early in the morning or late at night

- Must tell you who they are and why they are contacting you

- Cannot threaten you or use abusive language

However, despite these strict rules, these annoying phone calls and mail will still have a negative effect on you psychologically regardless of what time of the day it is or however they say it. Being in debt and getting chased by collection agencies is not a great feeling, which is why we work with Canadians to get those collection calls to stop.

When Can a Collection Agency Take You to Court?

So, when can a collection agency take you to court? This is the big question that brought you to this article.

It typically happens if you have ignored their calls and letters or refused to pay the debt. They might also sue if you dispute the debt but do not provide any proof or evidence to back up your claim.

However, suing someone can be expensive and time-consuming, so collection agencies often see it as a last resort. They will usually try to work something out with you before going that far.

Statute of Limitations in Canada

There is a time limit for how long a collection agency can sue you over unpaid debt. This is called the statute of limitations, and it varies depending on where you live in Canada. In most places, it is around two to six years from the last time you made a payment or acknowledged the debt.

Here is a quick overview of the statute of limitations in a few provinces:

- Ontario: 2 years

- British Columbia: 2 years

- Alberta: 2 years

- Quebec: 3 years

Once the statute of limitations has passed, can a collection agency take you to court? No, they cannot, but they may still contact you to try and collect the debt.

What Happens if a Collection Agency Takes You to Court?

Filing a Lawsuit

First, the agency will file a Statement of Claim with the court. You will receive a summons, which is a legal document that tells you they are suing you and explains what they are asking for.

Responding to a Summons

Do not ignore this! If you do, the court could automatically rule in favour of the collection agency. This is called a default judgment, and it could lead to things like wage garnishment or freezing your bank account.

Going to Court

If you respond to the summons, the case will go to court. Both sides (you and the collection agency) will present their evidence, and the judge will decide based on what is presented.

What Could Happen After Court?

Winning the Case

If you win the case, the collection agency will not be able to collect the debt, and they might not be able to sue you again for that debt.

Losing the Case

If the collection agency wins, they could get a judgment against you. This could result in:

- Wage garnishment: A portion of your pay cheque is taken to pay off the debt

- Bank account levies: The agency could take money directly from your bank account

- Property liens: A legal claim on your property, which could make it hard to sell

Settling the Debt

You do not always have to go to court. You can settle with the collection agency, which means you agree to pay part of the debt in exchange for them dropping the lawsuit. Settling can be a good option if you want to avoid the stress and costs of a court case, but it might still affect your credit score.

What to Do if You Are Sued

Talk to a Lawyer

If you get sued, it is a good idea to talk to a lawyer who specializes in debt collections. They can help you understand your rights and give you advice on what to do next.

Gather Your Documents

Get all the paperwork related to the debt, like payment receipts, letters from the creditor, and any communication with the collection agency. This will help you build a defence if you need to.

Possible Defences

You might have a good defence in court if:

- The statute of limitations has passed

- The debt is not yours

- You were not properly notified about the lawsuit

How to Avoid Being Sued by a Collection Agency

The best way to avoid getting sued is to stay on top of your debt and communicate with your creditors. Here are a few ways to stay in control:

- Reach out to creditors early: If you cannot make a payment, let your creditor know before it becomes a bigger problem.

- Explore debt management options: Debt consolidation, consumer proposals, or credit counselling could help you manage your payments.

There are excellent debt-relief solutions that can reduce and get rid of your debt, such as a consumer proposal, which is managed by Licensed Insolvency Trustees (LIT). It is a formal and legally binding debt settlement agreement between you and the companies you owe money to.

It can help you keep your assets, stop collection calls, and reduce your debt often by up to 80%. Our LITs handle all the negotiations with your creditors, which can help take the pressure off you.

Know Your Rights

You have rights as a debtor. Collection agencies are required by law to treat you fairly. They must follow the rules, and you can challenge them if they do not. For example, you can ask for proof that the debt is yours and that they have the right to collect it.

How Farber Can Help

At Farber, we understand how overwhelming debt can be, especially if you are worried about being taken to court. If you are asking yourself, can a collection agency take you to court, the answer might be yes, but we can help you avoid that outcome.

Our team can help you explore options like consumer proposals, debt consolidation, mortgage refinancing, or even bankruptcy to find a solution that works for you.

If you are concerned about a collection agency taking legal action, reach out to us today for a free consultation. We are here to help you get back on track!

Get out of debt

We offer a powerful debt-relief solution that can significantly reduce your debt without the drawbacks of declaring bankruptcy.

Take the first step

Book a free, confidential, no-obligation consultation and together, we can make a plan to help regain control of your money.

What you need to know

Although debt can be overwhelming, there are ways to start fresh and improve your relationship with money.